Argentina's Economic Rollercoaster: Milei's First Six Months in Office

Preface

Over the past few months, we have published various blogs on the subject of Argentina, scrutinizing the Milei plan—if such a plan truly exists—for its inconsistencies and predicting that the government's political frailty and harsh adjustments would undermine both the economy and societal support.

Incidentally, the reader with sufficient knowledge and overview of Argentine history over the last few decades should switch to the yellow light right away: the pure fiddling about with fiscal solutions without relying on the country's massive comapartitive advantages is a continuous tradition of all Argentine governments. The prevailing belief is that pure fiscal and monetary cunning will get the country out of the crisis, which has now been going on for seven decades and has brought the nation on the Rio de la Plata nine defaults.

social media cover

Six Months In: Evaluating Milei's Government

Now that the government has been in office for half a year, our initial diagnosis remains valid. Despite some victories, particularly in fiscal management, and maintaining solid support from 55% of the population, the underlying issues persist. A deeper look into Argentina's recent history shows a persistent belief that fiscal and monetary strategies alone can solve the country’s long-standing crisis, which has led to nine defaults over the past seven decades.

The Drama Unfolds

First, the executive's fragility must be highlighted. A look at the restructuring of the Brazilian crisis a few decades ago and the introduction of the real should serve as a good example of this. The restructuring of Brazil's crisis decades ago under President Fernando Henrique Cardoso, who led with determination and a well-prepared plan, stands in stark contrast to Milei's approach. Milei, instead, appears more interested in international right-wing gatherings than in leading the political-administrative operation at home.

In recent weeks, Milei’s political antics were on full display. He traveled to Spain not for diplomatic meetings but to rally with Spain’s ultra-right VOX party. In addition to attacks on the Spanish Prime Minister, verbal trades against free trade agreements such as the one between the European Union and Mercosur were fired off in staccato.

After the elections to the European Parliament, Milei frenetically congratulated the victorious far-right parties in countries like France and Germany, among others. These far-right parties are fervent opponents of free trade agreements. At the end of June 2024, Milei traveled to Germany to receive an award from the German rightwing-affiliated Hayek Foundation for Freedom and Free Trade in Hamburg. During his meeting with the German Chancellor, Milei emphasized his strong advocacy for a swift conclusion of the free trade agreement between the EU and Mercosur. However, on his home continent, Milei is boycotting Mercosur completely. His international engagements often contradict his domestic policies, causing friction and further weakening his position at home in the long run.

A few days ago, Argentinian President Milei canceled his participation in the Mercosur heads of state meeting. At the same time, however, next weekend, he will be attending the local southern American conference CPAC (Conservative Political Action) in the Brazilian state of Santa Catarina, in the seaside resort of Balneário Camboriú. Traditionally, this international conference of ultra-right and New Right/Alt Right groups is held in the USA. Brazilian MP Eduardo Bolsonaro, son of former Brazilian President Jair Messias Bolsonaro, brought this "franchsie" to South America a few years ago. It is safe to assume that there will also be another global all-out attack on the so-called globalists - another word to discredit those who see opportunities in globalization, global world trade and inclusive international cooperation.

With all this in mind, it is extremely difficult to understand why so many contemporaries, especially in Northern Europe, keep repeating the credo that Argentinian President Milei is supposedly an "ardent supporter of free trade agreements".

On the Home Front

Domestically, Milei’s need for support in Congress puts him in a bind. To gain backing from governors, he must release funds to the provinces, delaying crucial budget adjustments. While inflation has fallen from a peak of 25% monthly to around 4.5% in May, the overall rate remains alarmingly high at around 276%. This has led to seemingly paradoxical actions from Milei, such as imposing price controls despite his libertarian stance. The attentive reader will wonder: how can it be that a libertarian, anarcho-capitalist president arbitrarily intervenes in pricing? The answer probably lies much more in the fact that this is more of a social media narrative vs. Argentinian reality; by the way, similar tactical games in virtually every government in the Pampa Nation.

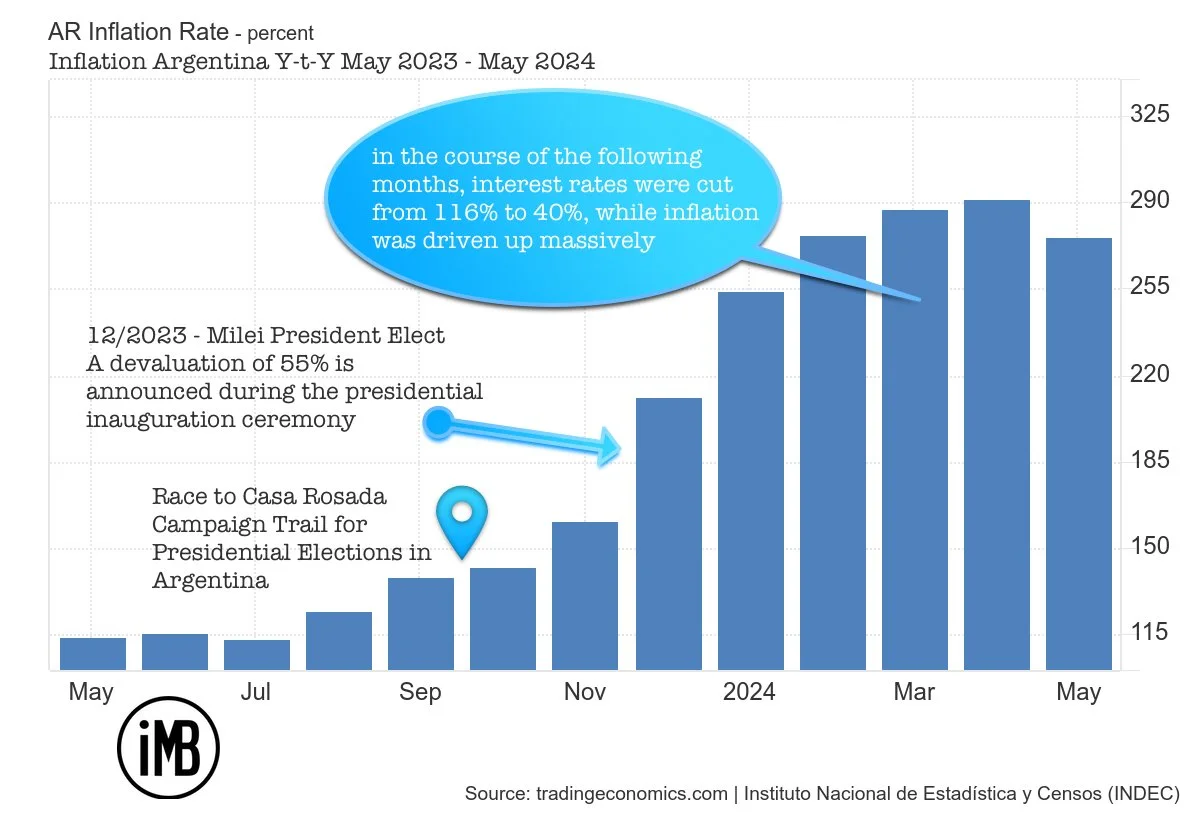

Historical development of Argentinian inflation over the course of 12 months

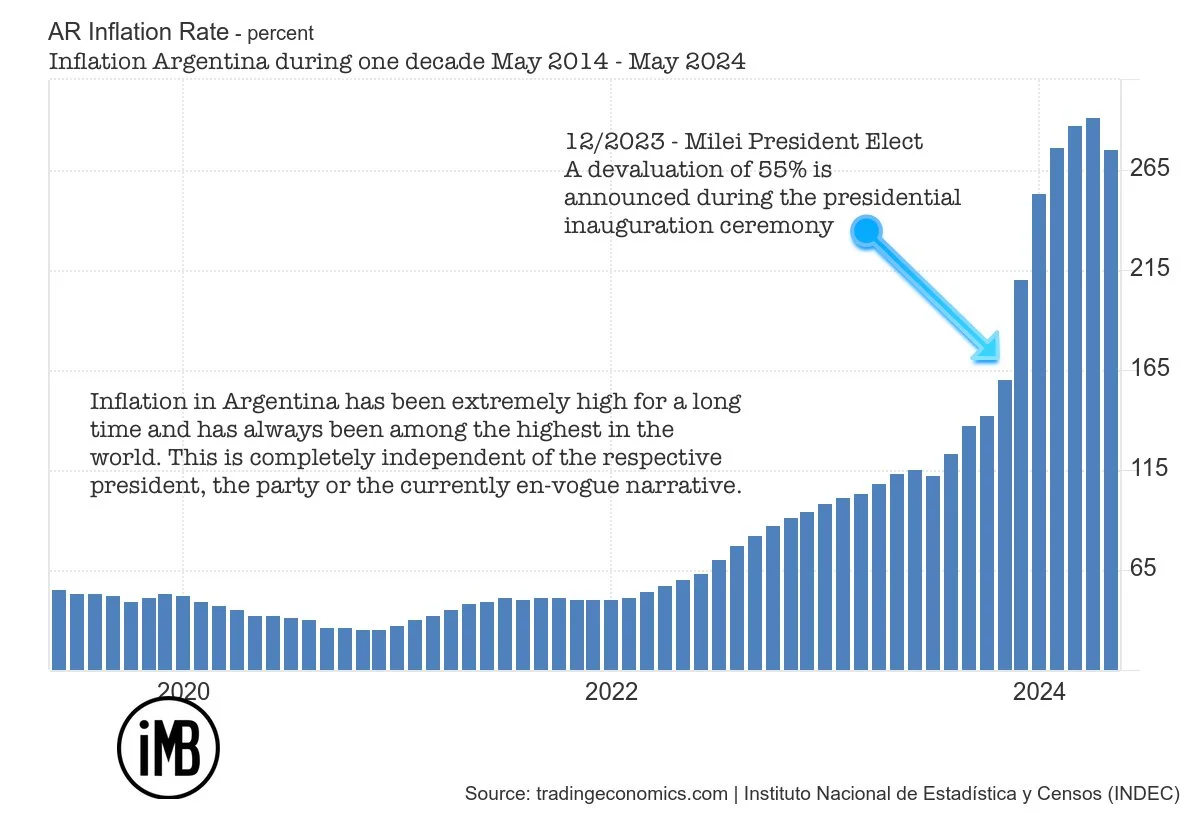

Historical development of Argentinian inflation over the course of one decade

If you take a moment to calm down and ignore the social media shouting about ideoligies that swings back and forth like a pendulum, you will quickly come to a conclusion. Regardless of the prevailing narrative, not much has changed in Argentina's situation. Economically, the nation has been a failed state for at least seven decades now. This is completely independent of the fact whether left-wing nationalist Peronists, right-wing nationalist Peronists, liberals in new clothes according to the fairy tale "The Emperor's New Clothes", or now self-declared libertarian anarch-capitalist bizzare figures are flushed into power.

In previous blogs and newsletters, we have tried to discuss the reasons for this extensively with our readers.

Last week, a bizarre spectacle unfolded in Buenos Aires. Argentina's Minister of Economy, Luis "Toto" Nicolás Caputo, explained the next steps of an alleged Argentine government restructuring plan. The explanations were very eloquent and the planned next steps were proclaimed in very rapid leaps. Hidden in the eloquence, the attentive listener found a highly interesting statement on the development of interest rates.

As shown above, the current government of President Milei has so far introduced many measures from day one of his presidency to ensure that inflationary pressure remains high. This is not to say that the measures were wrong, but that they did not include balancing measures to keep the economy on track. This is most clearly illustrated by the firing up of inflation to almost 300% with a simultaneous interest rate cut to 40% within less than five months.

Caputo's statement was that they were now working on creating conditions that would enable the government to raise interest rates again. So at the same time as Argentinians are currently pulling the last of their US dollar savings out from under the mattress to cover their living expenses, interest rates are to be raised to an appropriate level again in the foreseeable future. It should be assumed that monthly inflation will soon rise again. It has fallen temporarily, as Milei has ordered that many price adjustments in various sectors are prohibited. The Brave New World of a self-declared libertarian turns out to be a disguised application of the so-called Peronist tools that have been observed in Argentina for decades.

As a consequence, this probably means that interest rates will be raised when the Argentine government's “gigantic vacuum cleaner” has transferred the remaining wealth of a massively shrinking middle class entirely to the state.

Welcome to the Brave New World of a self-declared libertarian and anarcho-capitalist regime.

Looking Back: A Pattern of Failed Policies

The economic mismanagement is not new. When President Macri was elected, he was hailed as a new star in the liberal economy sky, especially in Northern Europe. Liberal narrative vs. reality - quite different outcome. His mission was nothing other than to negotiate the remaining debt with the so-called hangouts and the Elliot Management Fund and to bring about the eighth default at the time. And so it has been for decades. Who doesn't remember the Peronist Carlos Menem or the Peronist social-nationalists of the Kirchner clan? Different parties - same tactics.

Presidents from Macri to the Kirchners and now Milei have all followed similar paths, with different narratives but similar outcomes.

The Currency Crisis

The depreciation of the peso, fluctuating between 900 and 1,300 per dollar, jeopardizes the government’s economic adjustments. This depreciation, coupled with a central bank interest rate of around 40% and the inflation rate close to 280%, reveals the inconsistency in Milei’s policies. Despite claiming to be a libertarian, his actions show a different reality.

The weakening of the peso also jeopardizes the central bank's sharp cut in the key interest rate, which now stands at around 40%, which is strongly negative given that inflation is still in triple digits. The attentive reader may also pause for a moment here. Since Milei took office until today, he, the libertarian president, has lowered interest rates a total of five times. Anyone with a little knowledge of economic models should quickly realize that an inflation rate of around 280% cannot be administered with an interest rate of 40%. Or there is a completely different goal ... .

And yes, just a quick look back at the two charts above already shows a possible trend, which appears to be solely due to social media presence. As always in Argentina, it is the president who sets interest rates, price controls and exchange rates. Even today, President Milei has made no attempt to change this - so much for a self-declared libertarian.

Since taking office, inflation has been driven to heights that were only known in the times before Carlos Menem, although these were significantly higher. Due to many national defaults and the low interest rates in comparison with inflation, the last remaining savings of the Argentinian middle class are now being transferred from private accounts to the state as if in a gigantic vacuum cleaner (... this is the Brave New World of the Argentinian libertarian chief), finally initiating a massive impoverishment. It is clear to everyone that this will of course be followed by a massive slump in consumption. And it is also clear to everyone that inflation will then start to fall. But this inflation was previously massively fueled by the same President Milei.

huge transfer of remaining wealth of Argentinien middle-class to the state

The social media world and the corresponding political influencers are currently in a permanent state of exuberant celebration of the fall in inflation.

More cynicism is almost impossible.

By the way, yes, dear reader, there is no independent central bank in Argentina - it is the president who has been determining key interest rates, prices and exchange rates for decades - completely independently of who is in power in the Casa Rosada.

Difficult days lie ahead.

Facing Recession

The country is now undoubtedly entering a recession. This downturn, anticipated by Milei, poses a significant challenge. Recent weeks have seen political victories in Congress amidst intense public unrest, highlighting the tension that could either shatter his government or end Peronist dominance. The economic activity slump, particularly in construction and manufacturing, continues unabated, with agriculture being the only growing sector.

The Path Ahead

Milei’s unsparing analysis of Argentina’s economic dysfunctions has brought some immediate results: a surplus and falling inflation, but also a recession. The reforms passed by the Senate include measures for liberalization, foreign investment incentives, and privatization, though they are less comprehensive than Milei wanted. If you compare the first draft of the legislative package where "100% Milei" was printed with the current version, "Milei" can only be guessed at in outline. But it was his biggest political victory and showed that "El Loco" is capable of negotiating with the establishment.

Balance sheet at the end of June 2024

The first phase of the government ended relatively successfully. But the biggest challenge still lies ahead for the Argentine nation. Milei must decide on the future of the central bank (which he has promised to close) and the peso (which he wants to replace with the dollar).

There are signs that the peso is once again overvalued, driving away tourists, making exports more expensive and scaring off investors. Milei is leaning towards what he calls "endogenous dollarization": limiting the supply of pesos and betting that Argentines will get their dollars out of their mattresses when the economy needs them. And here the circle closes. Inflation close to 280% and an interest rate of 40%. Argentines don't have a choice to get their dollars out from under their mattresses - the state is pumping out dollars at an unprecedented rate.

Is this the Brave New World of the libertarians?

This heterodoxy would make it difficult to borrow from the IMF, which, like Milei's economic team, favors a system of "currency competition" similar to the Peruvian system, in which the dollar exists alongside the currency whose supply is adjusted by the central bank. Whether this system really works in Argentina is doubtful. After all, that was Carlos Menem's basis. The outcome is well known and led to the crisis that continues to this day.

The sheer numbers are remarkable in this context. While one camp is celebrating the development as a success, institutions such as the IMF and the World Bank are becoming somewhat uneasy.

Overall, sales in Argentinian shopping centers and supermarkets have slumped by -23% since December 2023 and private consumption has fallen by -17% in the same period. This is having a brutal impact on the social balance sheet. Today, between 55-60% of Argentinians live in poverty. The rate of extreme poverty is between 17-20%, while another 25% of the population is exposed to acute malnutrition.

According to the latest IMF report, 12% of Argentina's GDP is generated by state subsidies and 10% by public investment. A comparison with Brazil is interesting. Here, 5.8% represents expenditure on state subsidies and 16.5% is public investment.

Blog Hub - Publications Argentina Affair 2023/24

Conclusion: A Long Road Ahead

Argentina’s GDP fell by -5.1% in the first quarter of this year compared to the same period last year. This recession, driven by a sharp drop in consumption and devaluation of salaries and pensions, questions the sustainability of Milei's reform model.

The latest IMF and World Bank report paints a rapidly darkening picture. If a fundamental restructuring of Argentina is really to succeed, it will only be possible with a truly integral plan. Moreover, the process will take much longer than originally hoped. The lack of a consistent plan is once again noted.

Uncertainty remains, with Milei needing to balance political support with economic reforms. The mid-term elections in 2025 will be crucial. The question is whether Milei can navigate this turbulent path, prioritize pragmatism over ideology, and mobilize society for necessary reforms. For now, it seems like business as usual on the Rio de la Plata. Since decades.