Navigating Economic Turmoil: President Javier Milei's Quest to Solve Argentina's Debt Crisis

The Argentinian drama continues - is there a loophole?

Preface

The story of Argentina's insolvency, a world record, with debts amounting to more than USD 370 billion today. In Argentina, a brutal transfer of wealth from the middle class to the state is currently taking place, triggered by significantly lower interest rates and massively high inflation. Yes, it is like a cosmic atomic bomb.

On May 25, 2002, Jorge Bergoglio, then Archbishop of Buenos Aires, held a sober mass on the country's normally festive Independence Day. Argentina was in the midst of an economic crisis of enormous proportions, which had led to political chaos, social unrest and a worldwide record debt of almost 100 billion US dollars.

Bergoglio - now Pope Francis - issued a biblical warning to the country's furious creditors. He warned of the “danger of dissolution” and told the story of Zacchaeus, the tax collector who, after allowing Jesus to live in his house, donated half of his wealth to the poor. Soon after, Argentina went even further and imposed a 75 percent write-off discount for creditors. Eat bird or die!

The History Continues

That was just the beginning of a 15-year story that shook the financial world. Until the restructuring of Greek debt in 2012, it was the largest default ever recorded by a government. What made it so infamous was the remarkable legal trench warfare between Buenos Aires and its creditors, which brought to the fore fears about the messy processes of failing states that had until then only smoldered.

Collapsed governments are fascinating because they are a heady mix of finance, economics, politics, geopolitics and law.

The scale was immense. Argentina's liabilities were made up of 152 different instruments in 7 different currencies and 8 different jurisdictions. In addition to a plethora of international hedge funds and asset managers, there were more than half a million individual investors in countries such as Italy.

There, based on the cultural and historic proximity of the two countries, the Argentine government had managed to persuade Italian pension funds to invest their investors' money in Argentine government bonds. The zenith, however, was that they managed to sell Argentina as a first-class investor country - economically like the USA and culturally like Europe, of course. This led to 181 court cases in the Southern District of New York alone.

Creditors who refused to accept Argentina's harsh restructuring terms - led by Paul Singer's hedge fund Elliott Management - scoured the world for Argentine assets they could seize. These included the reserves of Argentina's central bank, the foreign earnings of the post office, economic satellites, the presidential airplane - and, famously, a ceremonial three-masted frigate when she visited Ghana.

All these efforts failed until 2012, when a remarkable turnaround occurred. Argentina's stubborn refusal to pay judgments against it prompted disgruntled investors to seek justice in the New York court, eventually taking radical action.

The court accepted Elliott Management's interpretation of an obscure legal clause in Argentina's bonds called “pari passu”. If Buenos Aires did not pay those who did not participate in the restructuring, the “hold outs,” the country would not be able to continue making payments to the vast majority of creditors in connection with the new bonds issued under the 2005 and 2010 debt agreements.

You have to seriously ask yourself how the Argentine government can be so brazen as to write down such conditions. But equally, how the hell can international investors accept such a thing?

In the judge's view, the damaging effects of Argentina's illegality - which he defined as willful and continuous non-compliance with the clearest obligations - made such drastic measures necessary. The rules had been refined further and further, criminally, by a wide variety of Argentine governments, regardless of political affiliation.

It worked!

At first, Argentina preferred to pay its debts rather than put a single cent in the hands of the hated “vultures” led by Elliott Management. But when the center-right reformer Mauricio Macri was elected in 2015, he struck a multi-billion dollar “deal” with the holdouts.

The case struck fear into the world of sovereign debt, as it could scupper any country's attempts to extricate itself from a debt crisis. If a creditor can reject a restructuring offer and hold it hostage until it is paid in full, why would anyone agree to a restructuring?

As has been the case for decades, Macri had not prepared a Plano Argentino and never had the intention of embarking on such hard work. In Argentina, elections are almost always held with one infamous intention: the next president should pull the wool over the eyes of international investors and negotiate another favorable debt restructuring. After that, the IMF can come in and once again flush USD into the country. The president can then leave - mission accomplished.

Elliott Management argued that the Argentine case was unique because of its “overbearing” attitude, the peculiar wording of its pernicious “pari passu” clause and a particularly ill-conceived local law that was expressly designed to relegate hold outs to a legal vacuum. It is true that Argentina is an extreme case.

This country is the world champion when it comes to defaults. To date, the country has accumulated nine defaults in less than 100 years.

Who doubts that a tenth is already in the pipeline? …

What can we learn from Argentina's sovereign defaults?

The result was unfortunate for Argentina. Macri lost the 2019 election, the country defaulted on another International Monetary Fund program and defaulted for the ninth time in 2020. Today, many fear a record-breaking tenth default under the new president Javier Milei.

An unhappy ending? No.

President Macri has described himself as liberal and conservative, but we must not get involved in this game in which the parties involved are trying to hoodwink us.

Like almost all other Argentine presidents, including the current one, he has joined a line of bizarre presidents who are always trying to find a cunning financial solution to the default. To date, no Argentine government has attempted a serious, well thought out and committed solution. It seems that Argentina doesn't know chess. No wonder a board game called “Legs up - perpetual debt” has become a hit in Argentina.

Fears that the great victory of the Argentine holdouts would lead to chaos in the restructuring of sovereign debt have not materialized, thanks in part to the increasing inclusion of “collective action clauses” in the bonds. These oblige all creditors to accept agreements that have been approved by a majority. However, many government bonds still lack such clauses. Debtors can also be affected by holdouts that focus on certain bonds - as happened in the case of a 1 billion dollar bond from Sri Lanka.

However, fears of similar lawsuits have been overshadowed by a bigger threat. China, a major creditor in the developing world, has played a role in hampering efforts to resolve subsequent debt crises in other countries such as Zambia.

In the absence of a bankruptcy procedure for countries, sovereign debt restructuring is likely to always remain a head-scratching, feet-clearing task: Solve one problem and another will arise elsewhere. The game is perfectly understood in the presidential palace in Buenos Aires. No matter who is president - the political or ideological background plays no role. That is why the current discussion about left-right, liberal, libertarian or anarcho-capitalism is complete nonsense. It's a Punch and Judy show that you shouldn't fall for.

Argentina's Economic Rollercoaster: A Journey Through Crisis and Default

Argentina's economy has seen more than its fair share of turbulence since the country gained independence in 1816. With nine defaults on its external debt, the nation’s financial history is marked by instability and recurring crises. Understanding the recent economic history and ongoing challenges can offer insight into Argentina's complex financial landscape and its potential future.

Only a very short-term look in the rear-view mirror shows more than clearly how much the Argentine governments, completely independent of their alleged ideological orientation, are actually only ever concerned with bringing about obviously positive scenarios in order to then negotiate the default once again to the advantage of the nation. To date, no Plano Argentino has ever been drawn up, discussed or articulated.

Macri's Reforms and Challenges (2015-2019)

When President Mauricio Macri assumed office in 2015, he introduced a series of economic reforms aimed at reversing the policies of his predecessors. These reforms included cutting export taxes, lifting currency controls, and resolving long-standing bond disputes. However, these measures had mixed results.

While Macri's policies were designed to stimulate the economy, they also led to rising borrowing costs and an increasing budget deficit due to external debt issuance. The Argentine peso became overvalued, contributing to economic vulnerabilities. A critical shortfall in Macri's presidency was the lack of initiatives to establish an independent central bank, which could have provided a stabilizing force in the economy. Critics argue that Macri’s policies set the stage for another default, aiming to renegotiate debt under more favorable terms.

Fernández Government and Debt Restructuring (2019-2020)

In the wake of the 2019 elections, the new center-left Peronist government led by Alberto Fernández and Cristina Fernández de Kirchner faced the daunting task of restructuring Argentina’s debt. These negotiations were necessitated by the financial instability inherited from the Macri administration. However, the COVID-19 pandemic exacerbated economic stress, culminating in a debt default in May 2020.

Of course, it has to be said that instability has been present in Argentina for decades. You don't know how far back to go. There is no doubt that the Peronist governments are fundamentally responsible for the economic catastrophe. The current crisis originally goes back to the disastrous end of the Peronist government under Carlos Menem.

Ongoing Challenges

Argentina's economic challenges did not end with the Fernández administration. Under the current presidency of Javier Milei, the country continues to struggle with balancing debt repayment, fiscal deficits, and rampant inflation. By April 2024, annual inflation had skyrocketed to nearly 290%, despite efforts to control it. The government’s strategy of lowering interest rates to stimulate growth further complicated the situation. As of mid-May 2024, the key interest rate stood at 40%, starkly contrasted with the soaring inflation rate.

The Hypothetical Path to Another Default

Exploring a hypothetical scenario where Argentina faces another default can shed light on the precarious nature of its economy.

External Shocks: A significant deterioration in global economic conditions, such as a sharp drop in commodity prices, would severely impact Argentina's export revenues. Concurrently, rising global interest rates would make it prohibitively expensive for Argentina to service its existing debt.

Fiscal Imbalance: Persistent fiscal deficits, driven by high public spending and inefficient tax collection, could force the government to increase borrowing. This fiscal imbalance would be exacerbated by social welfare programs that strain the budget.

Market Confidence Erodes: Investor confidence in Argentina’s ability to repay its debt could wane, leading to higher yields on Argentine bonds and increased borrowing costs. A depreciating peso would worsen inflation and complicate debt repayment efforts.

Political Instability: Internal political turmoil or policy uncertainty could further undermine investor confidence, potentially leading to capital flight and reduced foreign investment.

Debt Spiral: Higher borrowing costs and an increasing debt burden could trap Argentina in a vicious cycle, making default seem inevitable.

The Reality of Argentina's Current Economic Situation

Interest rate reductions in Argentina aim to boost economic activity, but they carry significant risks. Aggressive rate cuts could fuel inflation, creating a challenging environment where real interest rates are negative, discouraging saving and encouraging spending. This could further exacerbate inflation, creating a perilous economic cycle.

The combination of low interest rates and high inflation impacts Argentina's debt dynamics, increasing the real value of debt and making debt sustainability a daunting task. If the government continues to borrow heavily while inflation remains unchecked, the risk of default grows.

Back in Buenos Aires: El Loco calms down, negotiates and, contrary to expectations, pushes through his tough adjustment program

Good to know …

As of the latest available data, Argentina’s national government debt reached 370.7 billion USD in December 2023. It’s important to note that this figure is subject to change as new financial data becomes available and due to the dynamic nature of economic factors.

The Argentine Chamber of Deputies has passed a bill granting President Javier Milei extraordinary powers for one year to rule by decree in some areas of the administration. The first steps on the road to autocracy?

The approved package also contains a series of privatizations and several unpopular measures relating to pensions and income tax. The text will still go to the Senate, where Milei has an even more unimpressive base than in the Chamber of Deputies, but it is clear that the president, who has presented himself as a relentless tormentor of the political class in general, has realized that he depends on politics to govern - and that he is willing to make concessions.

El Loco has apparently gone soft, and Argentina seems ready for the administrative fiscal shock that the president promised in his noisy campaign.

Three months ago, to avoid a crushing defeat, the government had to withdraw the so-called Bus Law, a package of more than 600 articles that would have turned Argentina upside down. In March, the Decree of Necessity and Urgency (DNU), which has similar effects to a provisional measure, was rejected by the Senate. As the strategy of blaming the political caste jeopardized the stability of his government, Milei had to give in.

The package passed on April 30, 2024, the so-called Basic Law, ultimately comprised around 230 articles and was therefore much more modest than the Omnibus Law. In addition, Milei wanted four years of extraordinary powers and was only given one year in which to issue decrees on administrative, economic, financial and energy issues.

Milei will also have to make do with the privatization of 11 state-owned companies instead of the 40 he wanted, such as the airline Aerolineas Argentinas and the oil company Enarsa, and he also had to forego the sale of the Banco de La Nacion.

After Milei was forced by the courts to abandon a draconian labor reform, he had no choice but to talk to the unions. During the negotiations, the scope of the proposal was reduced from 60 to 16 articles. Milei also succeeded in establishing a minimum contribution period of 30 years for the full pension, reintroducing income tax for around 800,000 Argentinians and restoring the tax on profits.

The bills still have to pass the Senate, where they need at least 37 of the 72 votes. As Milei has a base of less than ten senators, he is dependent on the support of the so-called dialog opposition. The experience of successful negotiations with the governors, who control the seats in the Chamber of Deputies, shows that there is a way forward for the government package. It seems that Argentines are still willing to give Milei a vote of confidence, even in the face of harsh adjustment - or perhaps precisely because of it, since the legacy of populism and the irresponsibility of Peronism and Kirchnerism has dramatically impoverished the country. Approval ratings for the government remain high, but poverty has increased significantly, inflation is slow to fall and Argentina is likely to get much worse before it gets better. It will take nerves of steel, but Argentina seems to be on the right track. We will see.

Pros & Cons of President Javier Milei's economic reforms in Argentina

Milei, a politician, self-declared libertarian and anarch-capitalist and former radio host, has proposed bold measures to repair the economy and tackle inflation.

Pros of Milei's Reforms

Understanding Dollarization and Its Impact: In the realm of economic policy, the concept of dollarization often sparks intense debate. But what exactly does it mean? Dollarization involves adopting the US dollar as the official currency of a country. For Argentina, this could potentially stabilize the economy by reducing currency volatility and promoting foreign investment. Proponents argue that such a move could bring much-needed stability, while critics warn of the potential downsides. The idea of dollarization has become a hotly contested topic in Argentina. Over the past weeks, President Milei has found himself at the center of this debate. Despite advocating for dollarization initially, he now clarifies that there was never an original dollarization project. This shift in stance has led to widespread misunderstanding and controversy both domestically and globally. Recently, President Milei has made numerous statements clarifying his position on dollarization. Contrary to popular belief, he insists that he never proposed a strict dollarization plan. Instead, he emphasizes the need to ignite competition between different means of payment. This nuanced approach, following Milei, aims to bring more stability and flexibility to the Argentine economy. With President Milei's recent clarifications, the future of currency in Argentina remains uncertain but intriguing. While the idea of adopting the US dollar as the official currency might be off the table in this very moment, the focus now shifts to creating a more stable and competitive economic environment. This could involve a variety of measures aimed at reducing inflation and attracting foreign investment. (Note: so from USD, to EURO and shells and feathers, to crypto-currencies and rocks - welcome to the flat world of libertarians and anarch-capitalists).

Market Deregulation: By reducing regulations around credit cards and abolishing restrictions on private healthcare provision, Milei aims to create a more business-friendly environment. Deregulation can encourage entrepreneurship and attract investors.

Reducing Public Spending: Milei's goal of shrinking the state involves cutting public-sector spending by 5% of GDP. This fiscal discipline could lead to long-term benefits by reducing the budget deficit and debt burden.

Privatization of State-Owned Companies: The emergency decree issued by Milei includes steps to privatize Argentina's state-owned companies. Privatization can improve efficiency, increase competition, and attract private investment.

Cons of Milei's Reforms

Social Impact: Some of Milei's measures, such as reducing subsidies for transport, fuel, and energy, may cause economic pain for many families. Critics argue that these cuts disproportionately affect vulnerable populations. In addition to the pure cuts, there is a constant monthly devaluation brought about by the Milei government, an ever-increasing inflationary pressure, which leads to a collapse in consumption and, above all, hits the more than 60% impoverished population with all its might.

Labor Rights Concerns: The decree also includes limits on severance pay and maternity leave. Critics worry that these changes could negatively impact workers' rights and job security.

Opposition and Protests: Milei's reforms have stirred protests in Buenos Aires, Argentina's capital. Opposition groups, including unions, governors, and legislators, are pushing back against his agenda.

Congressional Challenges: The proposed omnibus legislation faced defeat in Congress, highlighting the difficulty of implementing sweeping reforms. Milei's policies must navigate political hurdles and legal challenges.

Summary of Proposal and how to get it Right or get Off Track

Javier Milei's proposed reforms have indeed sparked concerns about their social impact. While he emphasizes fiscal discipline and market-oriented policies, addressing the potential negative effects on vulnerable populations is crucial.

Targeted Social Assistance Programs: A Solution to Mitigate Subsidy Cuts

In light of potential subsidy cuts, implementing targeted social assistance programs could be a strategic move for Milei's administration. These programs aim to cushion the financial blow for low-income households who would be most affected by the reduction in subsidies for essential services like transport, fuel, and energy.

By providing direct financial support, these programs can help ensure that vulnerable populations continue to have access to basic necessities despite the cuts. This approach not only addresses immediate needs but also fosters a more equitable transition away from broad subsidies, ensuring that those who need assistance the most receive it directly.

Such measures can help maintain social stability and support economic reforms by protecting the living standards of the most disadvantaged citizens during times of fiscal adjustment.

Labor Market Reforms with Safeguards

Javier Milei's agenda to reduce labor costs is a significant aspect of his economic reforms. However, a balanced approach could involve introducing safeguards to protect workers' rights amidst these changes. For example, while aiming to cut down on severance pay to alleviate employer burdens, Milei could implement measures to ensure that these reductions do not disproportionately impact employees during layoffs. This dual approach could help maintain fair treatment of workers while pursuing economic efficiency, striking a balance between cost reduction and worker protection.

Gradual Implementation

Instead of implementing abrupt changes, Javier Milei could consider phasing in his reforms gradually. This approach provides ample time for adjustment, helping to minimize sudden shocks to vulnerable groups. By introducing changes step-by-step, Milei can ensure a smoother transition, allowing individuals and businesses to adapt more effectively to the new economic policies. This gradual implementation strategy could foster a more stable and sustainable reform process.

Consultation with Stakeholders

Engaging with labor unions, civil society organizations, and affected communities is essential for effective reform. Javier Milei could seek input and feedback from these stakeholders to refine his policies and address specific concerns. This collaborative approach ensures that diverse perspectives are considered, leading to more comprehensive and widely accepted reforms. By involving those directly impacted, Milei can build a stronger foundation for his policy changes and enhance their long-term success.

Transparency and Communication

Clear communication about the rationale behind reforms and their expected impact is crucial. Javier Milei should explain how these changes align with long-term economic stability and growth. By transparently sharing the goals and benefits of his policies, Milei can build public trust and understanding. This openness ensures that stakeholders are well-informed and can see the broader vision driving the reforms, fostering greater support and cooperation.

Monitoring and Evaluation

Establishing mechanisms to monitor the effects of reforms is vital. Regular evaluations can help identify unintended consequences and allow for timely adjustments. By continuously assessing the impact of his policies, Javier Milei can ensure that reforms are achieving their intended goals and make necessary corrections along the way. This proactive approach to monitoring and evaluation helps maintain the effectiveness and responsiveness of economic reforms.

In summary, while Milei's reforms aim to address Argentina's economic woes, their success depends on effective implementation, public acceptance, and managing potential social repercussions. Whether they gain momentum or fail remains a topic of intense debate and scrutiny. Remember that the success of these measures depends on effective implementation, public acceptance, and balancing economic goals with social well-being.

Argentine government's goal: Argentine central bank cuts interest rate to 40 percent, third cut in 14 days, to boost inflation to the maximum

Last month, the Argentinian monetary authority had already cut the key interest rate from 70 to 60 percent per year. One week later, the Central Bank of the Argentine Republic (BCRA) lowered the key interest rate from 60 percent to 50 percent per year. And a week later, it lowered it again to 40 percent.

“The BCRA's decision takes into account the financial and liquidity context and is based on the rapid adjustment of inflation expectations, the strengthening of the fiscal anchor and the contractionary monetary effects resulting from the seasonality of foreign payments of the treasury in the current quarter,” the Argentine central bank said in a statement.

Three weeks ago, the central bank cut the key interest rate by a further 10 percentage points, citing a “significant” slowdown in inflation amid a harsh and painful austerity program under new libertarian President Javier Milei.

Milei's austere fiscal policies have lifted investor sentiment in Argentina, boosting stocks, bonds and the peso, but with economic recession comes rising poverty as activity, production and consumption decline.

Argentina introduces 10,000 peso bills

The inflation rate is just under 300 percent: in Argentina, the central bank is reacting to the rapid devaluation of money by issuing completely new bills. First of all, it is the same Argentine government that is fueling the devaluation and inflation on a massive scale. The value of the new paper note is five times higher than that of the largest note to date.

10,000 peso: even larger bill already announced

In view of the galloping currency devaluation in Argentina, the size of the largest banknote in circulation has been increased to 10,000 pesos. This corresponds to approximately USD 12. The central bank made an announcement to this effect at the end of April 2024 in the capital Buenos Aires. The new money will be distributed gradually from now on via the network of bank branches and ATMs throughout the country.

The new bills feature portraits of Manuel Belgrano, one of Argentina's founding fathers, and María Remedios del Valle. Belgrano designed the Argentine flag at the beginning of the 19th century. María Remedios del Valle is regarded as a heroine of the struggle for independence from this period and is often praised as the “mother of the nation”.

Currently, many people in Argentina carry cash for simple transactions in their pockets, sometimes even in suitcases. The annual inflation rate in the country reached almost 290% in April, making it the highest in the world.

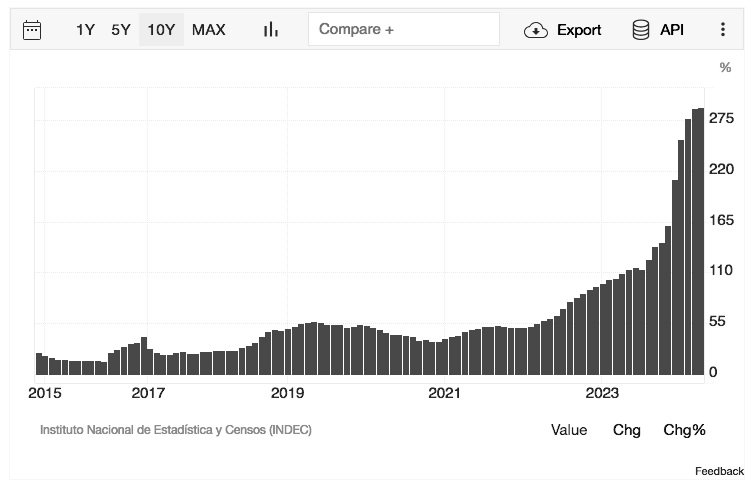

The inflation rate in Argentina has seen a significant increase over the past 12 months. As of April 2024, the inflation rate reached 289.40%, marking the highest increase since February 1991. This is an acceleration from the previous month’s rate of 287.90%. The inflation rate has been on a rising trend, with a notable year-over-year increase. For example, in March 2023, the 12-month inflation rate clocked in at 102.5%, with a monthly rise of 6.6% in the Consumer Price Index (CPI) and a 13.1% year-to-date increase.

Inflation in Argentina

monthly Repro rate (in %)

These figures reflect the ongoing economic challenges in Argentina, with a significant upward trend in inflation during the latter half of 2023. The high inflation rates have various economic implications, including the loss of purchasing power and increased poverty among the population. The data indicates that the country has been grappling with the issue of inflation consistently throughout the year.

Immediately after President Javier Milei took office, a massive wave of devaluation of the Argentinian peso began, accompanied by a drastic reduction in the key interest rate. The remaining financial assets, especially those of the middle class, are being transferred to the state at breathtaking speed. The inflation curve flattens out as a massive economic crisis is fueled further and consumption collapses drastically.

The economic Earth in Argentina is flat ...!

Argentina's central bank slashed the benchmark interest rate to 40% from 50% on May 15th, marking the sixth adjustment since December due to a slowdown in the inflation rate, bringing the rates to the lowest since June 2022. The monthly inflation rate slowed for the fourth straight month to 8.8% in April 2024 from 11% in the previous month and below market forecasts of a 9% gain. The inflation rate continued to slow from a peak last December of 25.5% after sharply devaluating the local peso currency. President Javier Milei's administration has prioritized stringent spending cuts since December to combat inflation, with his economic team forecasting monthly inflation to decrease to 3.8% by September. On a yearly basis, however, inflation accelerated to 289.4% in April from 287.9% in March.

In reality, however, this means that a large proportion of the repayments are simply not being paid and the continuous devaluation of the Argentine peso is being driven forward unwaveringly. This is being massively fueled by the seemingly insane constant interest rate cuts, among other things.

To make it clear: there is a self-declared libertarian and anrach-capitalist president, who supposedly would also follow the orthodox methods of Milton Friedman, but who in his function as president massively pushes down the key interest rate.

Do you think you have read wrong? A president who sets the key interest rate?

Yes, dear reader, that's exactly how it is in Argentina: there is no independent central bank. The president sets the key interest rate, exchange rates, price controls etc.. And this has not changed to this day.

Why the supposedly libertarian and anarch-capitalist president of Argentina has not introduced any laws or projects to change this remains a mystery. There is probably an explanation:

President Milei is not one iota different from all the other bizarre, economic flat Earth fantastics who have been elected president in Argentina.

The poverty rate in Argentina has seen a significant increase recently. As of January 2024, the poverty level hit 57.4% of the population, which is the highest rate in 20 years. This means that about 27 million people in Argentina are considered poor, with 15% of those in “destitution,” unable to adequately cover their food needs. The official statistical figures are tending to become increasingly opaque, although the poverty rate is likely to have risen to well over 60% in April. The extreme poverty rate appears to be around 30%. These are also unprecedented figures for Argentina.

The rise in poverty was partly attributed to the devaluation of the Argentine peso implemented by President Javier Milei’s government, which led to an increase in the prices of basic goods and services. This economic situation has had the greatest impact on working- or middle-class households that do not receive benefits through social programs. These figures reflect a challenging socioeconomic reality in Argentina, with a significant portion of the population facing hardships.

Is there a roadmap for a Plano Argentino?

Until the 1990s, Brazil and Argentina were indistinguishable from one another. Today, Brazil has many problems, but if you look at Argentina, you get the impression that the nation belongs to another planet. And looking at the economic discussion in the country, Argentina seems to have been living on a flat planet for decades, with bizarre personalities pretending to be president.

Daily life combined with inflation is simply chaos. Inflation has been almost 290% in the last 12 months and is still rising. In the first three months of 2024, average monthly inflation was 15%. Adjustments to a number of variables, which until a few years ago were annual, are now made every six months, then every four months, quarterly and sometimes monthly. As the country prepares for its umpteenth negotiation with the IMF, there are strikes, uncertainty, etc. That's how it was in Brazil back then - in the past. We can remember it ourselves.

If that is no longer the case, now that June 2024 marks the 30th anniversary of the Real Plan, it is time to recognize the role that a group of individuals played in 1994 to bring about this change, which has become a turning point in Brazil. We also remember the reaction in Argentina: they ridiculed their foolish brother to the north, looked arrogantly at the USD in their own hands and boasted that they could simply buy up everything in Brazil. Only in Chile was there deep admiration for the Brazilian process.

When you see what everyday life is like in the country on the Rio de la Plata, which is struggling with the same problems as Brazil 30 years ago, you realize what this Brazilian team was capable of. Under the political leadership of Fernando Henrique Cardoso, know as FHC, and the skillful management of Pedro Malan, the group of “Fathers of the Real”, the dream team of Gustavo Franco, Pérsio Arida, Edmar Bacha, André Lara Resende and Winston Fritsch, who also benefited from the reflections of Francisco Lopes and Eduardo Modiano in previous years - although they were not part of the team - devised a plan with a great deal of ingenuity.

It was the result of ten years of intensive discussions within the economics department of the PUC-RJ under the intellectual leadership of Dionísio Dias Carneiro and Rogério Werneck. In the current polarized world, the PUC is located on the left. So much for the shift in perception and discourse (…).

This plan enabled the transition from a Brazil with inflation of 50 percent per month to a country with inflation of 4 percent per year. This plan was heavily criticized at the time by the PT, the workers' party, which rejected it in every way, arguing that it would have a recessionary effect and fail, like the five previous stabilization plans that had been attempted since 1986. It should be remembered that when the PT came to power in Brazil, it became a staunch defender of the Real plan, as did previous governments.

In Argentina today, at least for the time being, there is no consolidated reflection on the implementation of a stabilization plan. Nor is there anyone thinking about implementing a stabilization plan and de-indexing the economy, as was the case in Brazil in 1994. And certainly not someone with the skills of FHC. Political leadership and technical consistency: lucky for the country when these two things come together. That was the happy combination that Brazil had 30 years ago.

Overview of Political Parties and Groups in Argentina

Liberal Party (Milei's Party)

The Liberal Party, founded by Milei, fully supports his reforms. They believe that bold measures are necessary to address Argentina's economic crisis. They see dollarization, deregulation, privatization and the abolition of the State as essential steps toward stability and growth.

Radical Civic Union (UCR)

The UCR, a centrist party, has mixed opinions. While some members appreciate the focus on fiscal discipline and market-oriented policies, others express concerns about the social impact. They advocate for a more gradual approach to avoid abrupt shocks.

Peronist Parties (Justicialist Party and Allies)

Peronist parties, including the Justicialist Party, have been vocal critics of Milei's reforms. They argue that the proposed cuts to subsidies and labor rights disproportionately affect working-class citizens. They emphasize the need for social safety nets.

Socialist Party (PS)

The PS leans left and opposes Milei's reforms. They believe that privatization and deregulation could exacerbate inequality. They advocate for alternative solutions, such as targeted social programs and progressive taxation.

Left-Wing Movements (Workers' Party, MST, etc.)

Left-wing movements are staunch opponents of Milei's agenda. They view it as an attack on workers' rights and public services. They call for increased public spending, nationalization of key industries, and wealth redistribution.

Conservative Parties (Propuesta Republicana, PRO)

Some conservative parties cautiously support certain aspects of Milei's reforms, such as privatization. However, they also express concerns about potential social unrest and advocate for a balanced approach.

In summary, political parties in Argentina have diverse opinions on Milei's reforms, ranging from enthusiastic support to strong opposition. The success or failure of these reforms will depend on their implementation, public acceptance, and the ability to navigate political challenges .

Conclusion

In conclusion, the unfolding situation in Argentina under President Javier Milei presents a complex and multifaceted challenge. The nation's long-standing issues with debt and economic instability require bold and decisive action, yet the path forward is fraught with difficulties. Milei's radical proposals for economic reforms, while potentially transformative, must be carefully balanced against the risks of exacerbating existing social tensions and economic vulnerabilities.

Argentina's economic history suggests that addressing structural issues and maintaining sustainable policies are crucial to avoiding further defaults. The current economic strategies, including high inflation and low-interest rates, signal potential risks that could lead to another default. The Milei government’s focus on aggressive fiscal policies and political positioning may create short-term gains but also poses long-term risks. Without substantial reforms and a clear economic plan, Argentina's cycle of economic crises and defaults may continue.

Inflation rate in Argentina since 2015: anyone who does not believe that such a development is preparing the ground for another, and this time infernal, Argentine default may wake up as if in a very bad libertarian and anarcho-capitalist dream …, source: TradingEconomics.com, May 2024

In Argentina, a brutal transfer of wealth from the middle class to the state is currently taking place, triggered by significantly lower interest rates and massively high inflation. The combination of these factors is causing savings to rapidly lose value, while at the same time the state is benefiting from the precarious financial situation of many citizens. This trend shows how economic decisions and external factors can contribute to a major change in the balance of wealth distribution within a society. The middle class suffers the most under these conditions, as it does not have the resources to effectively protect itself against the loss of its wealth. This situation particularly affects those Argentines who receive most or all of their income in Argentine pesos, i.e. pensioners, retirees and salaried employees.

There is no other place where it is so clear that the current Milei government does not follow libertarian economic guidelines. Nor is it enough, as in the case of President Milei, to call one of his dogs Milton, in reference to Milton Friedman. There is probably no plan - there never was - in the tradition of the Argentine presidents of the past decades. And so they are all Peronists, libertarians, liberals, ultra-right, ultra-left - it doesn't matter - it doesn't matter at all.

The resolution of Argentina's debt crisis will depend not only on domestic policy changes but also on the dynamics of international financial negotiations and legal battles. The involvement of key players like Elliott Management and the historical context provided by figures such as Pope Francis adds layers of complexity to this already intricate scenario.

As Argentina navigates this turbulent period, the world watches closely. The outcomes here will not only determine the future of Argentina but could also provide valuable lessons for other nations grappling with similar economic challenges. The hope is that through strategic reforms, international cooperation, and sustainable economic practices, Argentina can emerge from this crisis with a more stable and prosperous future.

If … .

Where is the Plano Argentino?